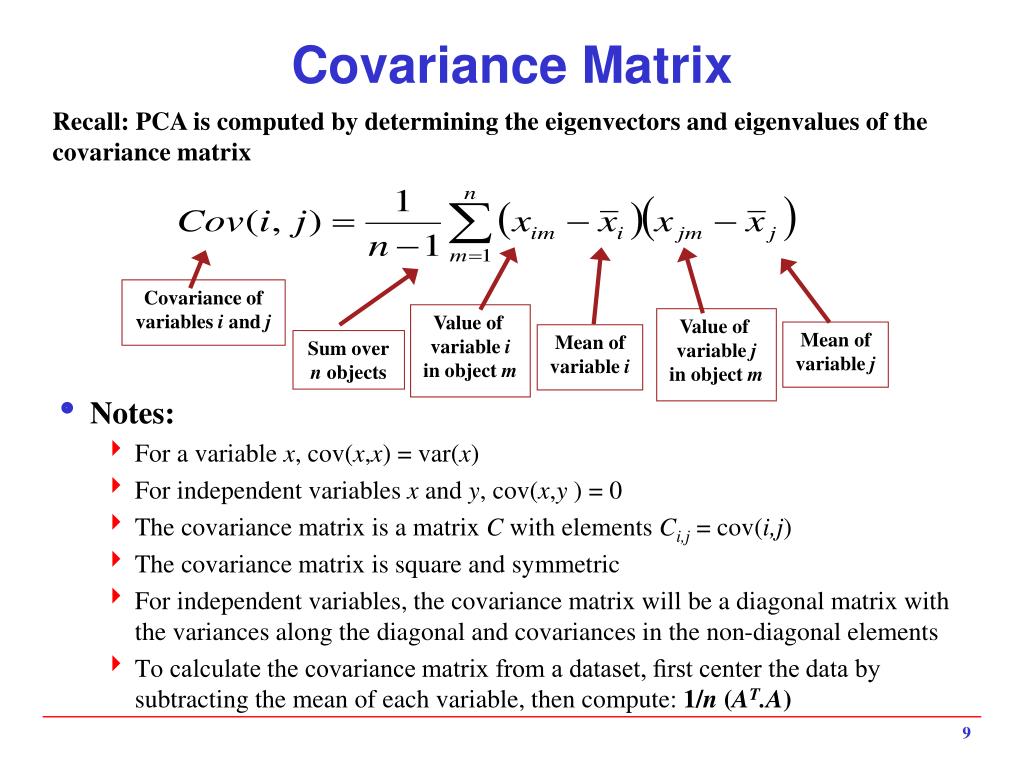

In data analysis, the covariance matrix has a vital role.The principal component is another application of the covariance matrix to original variables to linear independent variables.read more to correlate the random variables. read more in financial engineering Financial Engineering Financial engineering is field which uses mathematical techniques, financial theories, engineering tools and advanced programming techniques to solve critical and complex financial problems. It can be used in stochastic modeling Stochastic Modeling Stochastic modeling develops a mathematical or financial model to derive all possible outcomes of a given problem or scenarios using random input variables.

The covariance matrix tells the relationship among the different dimensions of random variables.In machine learning, determine the dependency patterns between the two vectors.Analyzing how two vectors are differentiated from each other.The covariance matrix is used in various applications, including:

#Covariance matrix how to

Source: Covariance Matrix in Excel () How to Use a Covariance Matrix in Excel?

#Covariance matrix free

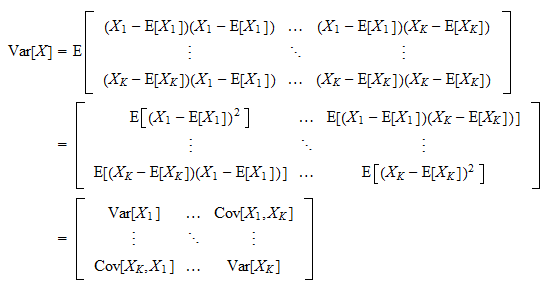

You are free to use this image on your website, templates, etc., Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked One point to remember about this matrix is the result from the NXN covariance matrix for data of n-dimensional. This indicates that COV(X,Y)=COV(Y,X), COV(X,Z)=COV(Z,X), and COV(Y,Z)=COV(Z,Y). The covariance matrix is symmetric concerning diagonal. The diagonal values of the matrix represent the variances of X, Y, and Z variables (i.e., COV(X, X), COV(Y, Y), and COV (Z, Z)). To create the 3×3 square covariance matrix, we need to have three-dimensional data.

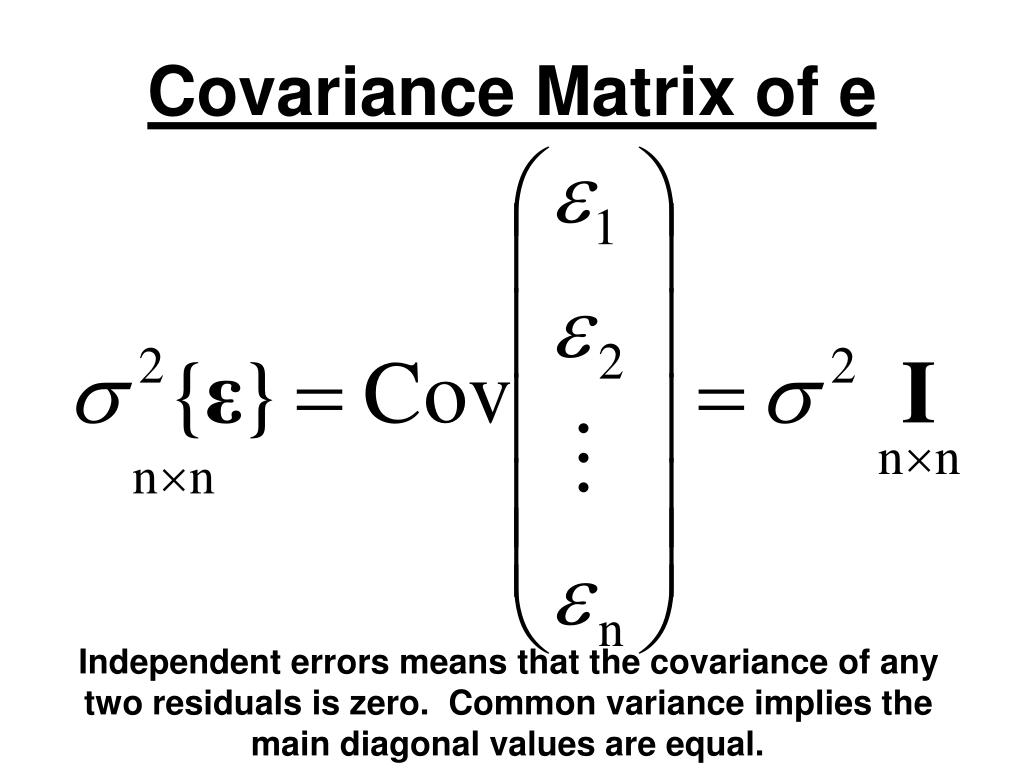

The three-dimensional covariance matrix is shown as: The covariance matrix is represented in the following format. A negative value indicates that if one variable decreases, the other increases, and an inverse relationship exist between them. A positive value indicates that two variables will decrease or increase in the same direction. The covariance will have both positive and negative values. It is easy and useful to show the covariance between two or more variables. The covariance matrix is a square matrix to understand the relationships presented between the different variables in a dataset. The following formula is used for covariance determination. How to Use a Covariance Matrix in Excel?Ĭovariance is one of the measures used for understanding how a variable is associated with another variable.In such a scenario, we can use the covariance matrix function that helps to display the covariance between a pair of datasets and the variance shown by the dataset elements. We need to determine the joint variability of the given variables in a dataset. The present article will explain the covariance matrix calculation in Excel by covering the following topics.įor example, suppose we have an Age(X) and Score (Y) dataset. Excel presented an inbuilt “Data Analysis” tool to determine the covariance between the data sets. read more among the columns and variance in columns. when the returns of one asset goes up, the return of second assets also goes up and vice versa for negative covariance. If it gives a positive number then the assets are said to have positive covariance i.e. The covariance matrix is a square matrix to show the covariance Covariance Covariance is a statistical measure used to find the relationship between two assets and is calculated as the standard deviation of the return of the two assets multiplied by its correlation.

0 kommentar(er)

0 kommentar(er)